77. The Aiyagari Model with Endogenous Grid Method#

In addition to what’s included in base Anaconda, we need to install JAX

!pip install quantecon jax

77.1. Overview#

This lecture combines two important computational methods in macroeconomics:

The Aiyagari model [Aiyagari, 1994] - a heterogeneous agent model with incomplete markets

The endogenous grid method (EGM) [Carroll, 2006] - an efficient algorithm for solving dynamic programming problems

In the standard Aiyagari lecture, we solved the household problem using Howard policy iteration (a value function iteration variant) and computed aggregate capital using the stationary distribution of the finite Markov chain.

In this lecture, we take a different approach:

We use the endogenous grid method to solve the household problem via the Euler equation, avoiding costly root-finding operations

We compute aggregate capital by simulation rather than calculating the stationary distribution analytically

These modifications make the solution method faster and more flexible, especially when dealing with more complex models.

77.1.1. References#

The primary references for this lecture are:

[Aiyagari, 1994] for the economic model

[Carroll, 2006] for the endogenous grid method

Chapter 18 of [Ljungqvist and Sargent, 2018] for textbook treatment

77.1.2. Preliminaries#

We use the following imports:

import quantecon as qe

import matplotlib.pyplot as plt

import jax

import jax.numpy as jnp

from typing import NamedTuple

from scipy.optimize import bisect

import numpy as np

from numba import jit

Matplotlib is building the font cache; this may take a moment.

We will use 64-bit floats with JAX in order to increase precision.

jax.config.update("jax_enable_x64", True)

77.2. The Economy#

77.2.1. Households#

Infinitely lived households face idiosyncratic income shocks and a borrowing constraint.

The savings problem faced by a typical household is

subject to

where

\(c_t\) is current consumption

\(a_t\) is assets

\(z_t\) is an exogenous component of labor income (stochastic employment status)

\(w\) is a wage rate

\(r\) is a net interest rate

\(B\) is the maximum amount that the agent is allowed to borrow

The exogenous process \(\{z_t\}\) follows a finite state Markov chain with stochastic matrix \(\Pi\).

The Euler equation for this problem is

or, in terms of assets,

where \(a'(a, z)\) is the optimal savings policy function.

77.2.2. Firms#

Firms produce output by hiring capital and labor under constant returns to scale.

The representative firm’s output is

where

\(A\) and \(\alpha\) are parameters with \(A > 0\) and \(\alpha \in (0, 1)\)

\(K\) is aggregate capital

\(N\) is total labor supply (normalized to 1)

These parameters are stored in the following namedtuple:

class Firm(NamedTuple):

A: float = 1.0 # Total factor productivity

N: float = 1.0 # Total labor supply

α: float = 0.33 # Capital share

δ: float = 0.05 # Depreciation rate

From the firm’s first-order condition, the inverse demand for capital is

def r_given_k(K, firm):

"""

Inverse demand curve for capital.

"""

A, N, α, δ = firm

return A * α * (N / K)**(1 - α) - δ

The equilibrium wage rate as a function of \(r\) is

def r_to_w(r, firm):

"""

Equilibrium wages associated with a given interest rate r.

"""

A, N, α, δ = firm

return A * (1 - α) * (A * α / (r + δ))**(α / (1 - α))

77.2.3. Equilibrium#

A stationary rational expectations equilibrium (SREE) consists of prices and policies such that:

Households optimize given prices

Firms maximize profits given prices

Markets clear: aggregate capital supply equals aggregate capital demand

Aggregate quantities are constant over time

77.3. Implementation with EGM#

77.3.1. Household primitives#

First we set up the household parameters and grids:

class Household(NamedTuple):

β: float # Discount factor

a_grid: jnp.ndarray # Asset grid

z_grid: jnp.ndarray # Exogenous states

Π: jnp.ndarray # Transition matrix

def create_household(β=0.96, # Discount factor

Π=[[0.9, 0.1], [0.1, 0.9]], # Markov chain

z_grid=[0.1, 1.0], # Exogenous states

a_min=1e-10, a_max=50, # Asset grid

a_size=200):

"""

Create a Household namedtuple with custom grids.

"""

a_grid = jnp.linspace(a_min, a_max, a_size)

z_grid, Π = map(jnp.array, (z_grid, Π))

return Household(β=β, a_grid=a_grid, z_grid=z_grid, Π=Π)

For utility, we assume \(u(c) = \log(c)\), which gives us \(u'(c) = 1/c\) and \((u')^{-1}(x) = 1/x\).

@jax.jit

def u(c):

return jnp.log(c)

@jax.jit

def u_prime(c):

return 1 / c

@jax.jit

def u_prime_inv(x):

return 1 / x

Here’s a namedtuple for prices:

class Prices(NamedTuple):

r: float = 0.01 # Interest rate

w: float = 1.0 # Wages

77.3.2. The EGM operator#

The key insight of EGM is to avoid root-finding by choosing the asset grid exogenously and computing the consumption values directly from the Euler equation.

The Coleman-Reffett operator using EGM works as follows:

Start with a consumption policy function \(\sigma\) represented on an exogenous grid of assets \(\{a_i\}\)

For each asset level \(a_i\) and employment state \(z_j\):

Compute the right-hand side of the Euler equation: $\(\text{RHS} = \beta (1 + r) \sum_{z'} \Pi(z_j, z') u'(\sigma(a_i, z'))\)$

Use the inverse marginal utility to get current consumption: $\(c_{ij} = (u')^{-1}(\text{RHS})\)$

Compute the endogenous income level: $\(y_{ij} = c_{ij} + a_i\)$

Reconstruct the new policy \(K\sigma\) on the original asset grid using interpolation

@jax.jit

def K_egm(σ, household, prices):

"""

The Coleman-Reffett operator using EGM for the Aiyagari model.

Parameters

----------

σ : array_like(float, ndim=2)

Current consumption policy, where σ[i, j] is consumption

when assets are a_grid[i] and employment state is z_grid[j]

household : Household

Household parameters and grids

prices : Prices

Interest rate and wage

Returns

-------

σ_new : array_like(float, ndim=2)

Updated consumption policy on the same grid

"""

# Unpack

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

r, w = prices

# Allocate memory for new consumption

σ_new = jnp.zeros((a_size, z_size))

# For each current employment state

for j in range(z_size):

# Step 1: Use a_grid as exogenous grid for tomorrow's assets (a')

# Compute expectation: E[u'(c(a', z')) | z=z_j]

Eu_prime = jnp.zeros(a_size)

for jp in range(z_size):

Eu_prime += Π[j, jp] * u_prime(σ[:, jp])

# Step 2: Get consumption on endogenous grid using Euler equation

c_endo = u_prime_inv(β * (1 + r) * Eu_prime)

# Step 3: Compute endogenous asset grid for today

# From budget constraint: a' = (1+r)a + wz - c

# Solving for a: a = (c + a' - wz) / (1+r)

a_endo = (c_endo + a_grid - w * z_grid[j]) / (1 + r)

# Step 4: Interpolate back to exogenous asset grid

# Handle borrowing constraint

for i, a in enumerate(a_grid):

if a < a_endo[0]:

# Below minimum of endogenous grid - consume all income

σ_new = σ_new.at[i, j].set(w * z_grid[j] + (1 + r) * a - a_grid[0])

else:

# Interpolate

σ_new = σ_new.at[i, j].set(jnp.interp(a, a_endo, c_endo))

return σ_new

Let’s also create a more efficient JIT-compiled version:

@jax.jit

def K_egm_jit(σ, household, prices):

"""

Vectorized JIT-compiled version of the EGM operator.

"""

# Unpack

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

r, w = prices

# Compute expectation: E[u'(c(a', z')) | z]

# Eu_prime[i, j] = sum_jp Π[j, jp] * u'(σ[i, jp])

Eu_prime = (Π @ u_prime(σ).T).T # (a_size, z_size)

# Apply Euler equation to get consumption on endogenous grid

c_endo = u_prime_inv(β * (1 + r) * Eu_prime) # (a_size, z_size)

# Compute endogenous asset grid: a = (c + a' - wz) / (1+r)

# a_endo[i, j] is today's assets when tomorrow's assets are a_grid[i]

# and today's employment is z_grid[j]

a_endo = (c_endo + a_grid[:, None] - w * z_grid[None, :]) / (1 + r)

# Interpolate back to exogenous grid

# For each employment state j, interpolate from (a_endo[:, j], c_endo[:, j])

# to get consumption at exogenous grid points a_grid

def interpolate_policy(j):

# Handle borrowing constraint

# If a < min(a_endo), consume everything except minimum savings

return jnp.where(

a_grid < a_endo[0, j],

w * z_grid[j] + (1 + r) * a_grid - a_grid[0],

jnp.interp(a_grid, a_endo[:, j], c_endo[:, j])

)

σ_new = jax.vmap(interpolate_policy)(jnp.arange(z_size))

return σ_new.T # (a_size, z_size)

77.3.3. Solving the household problem#

We solve for the optimal policy by iterating the EGM operator to convergence:

def solve_household_egm(household, prices,

tol=1e-5, max_iter=1000, verbose=False):

"""

Solve the household problem using EGM iteration.

Returns the optimal consumption policy σ[i,j] where i indexes

assets and j indexes employment states.

"""

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

# Initial guess: consume a fraction of income

r, w = prices

a_mesh = a_grid[:, None]

z_mesh = z_grid[None, :]

income = w * z_mesh + (1 + r) * a_mesh

σ = 0.5 * income

# Iterate until convergence

for i in range(max_iter):

σ_new = K_egm_jit(σ, household, prices)

error = jnp.max(jnp.abs(σ_new - σ))

σ = σ_new

if verbose and i % 50 == 0:

print(f"Iteration {i}, error = {error:.6f}")

if error < tol:

if verbose:

print(f"Converged in {i} iterations")

break

return σ

Let’s test this on an example:

# Create household and prices

household = create_household()

prices = Prices(r=0.01, w=1.0)

print(f"Solving household problem with r={prices.r}, w={prices.w}")

# Solve

with qe.Timer():

σ_star = solve_household_egm(household, prices, verbose=True)

Solving household problem with r=0.01, w=1.0

Iteration 0, error = 7.907526

Iteration 50, error = 0.006472

Iteration 100, error = 0.000021

Converged in 106 iterations

0.83 seconds elapsed

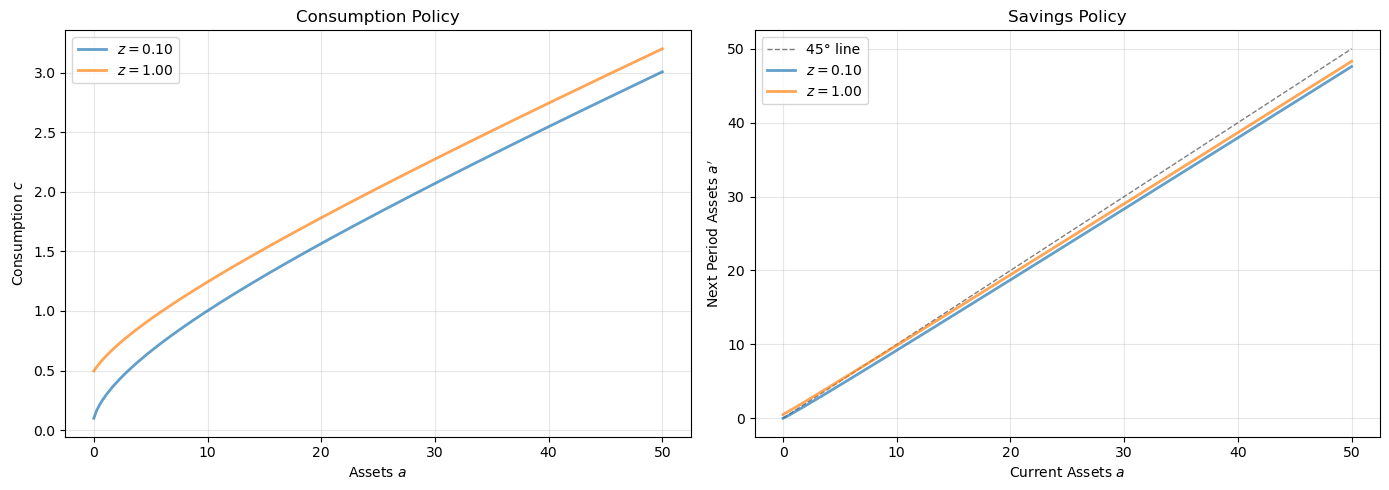

Let’s plot the resulting policy functions:

β, a_grid, z_grid, Π = household

r, w = prices

# Convert consumption policy to savings policy

a_mesh = a_grid[:, None]

z_mesh = z_grid[None, :]

income = w * z_mesh + (1 + r) * a_mesh

savings = income - σ_star

fig, axes = plt.subplots(1, 2, figsize=(14, 5))

# Plot consumption policy

ax = axes[0]

for j, z in enumerate(z_grid):

ax.plot(a_grid, σ_star[:, j], label=f'$z={z:.2f}$', lw=2, alpha=0.7)

ax.set_xlabel('Assets $a$')

ax.set_ylabel('Consumption $c$')

ax.set_title('Consumption Policy')

ax.legend()

ax.grid(alpha=0.3)

# Plot savings policy

ax = axes[1]

ax.plot(a_grid, a_grid, 'k--', lw=1, alpha=0.5, label='45° line')

for j, z in enumerate(z_grid):

ax.plot(a_grid, savings[:, j], label=f'$z={z:.2f}$', lw=2, alpha=0.7)

ax.set_xlabel('Current Assets $a$')

ax.set_ylabel('Next Period Assets $a\'$')

ax.set_title('Savings Policy')

ax.legend()

ax.grid(alpha=0.3)

plt.tight_layout()

plt.show()

77.4. Computing Aggregate Capital by Simulation#

Instead of computing the stationary distribution of the Markov chain analytically, we compute aggregate capital by simulating a large number of households.

This approach:

Is more flexible (works with continuous shocks, non-linear policies, etc.)

Avoids storing and manipulating large transition matrices

Is conceptually simpler

@jax.jit

def simulate_households(σ, household, prices,

num_households=10_000,

num_periods=1000,

seed=42):

"""

Simulate a cross-section of households and compute average assets.

Parameters

----------

σ : array_like(float)

Consumption policy function

household : Household

Household parameters

prices : Prices

Interest rate and wage

num_households : int

Number of households to simulate

num_periods : int

Number of periods to simulate (we use the last period)

seed : int

Random seed

Returns

-------

mean_assets : float

Average asset holdings across households

"""

β, a_grid, z_grid, Π = household

r, w = prices

z_size = len(z_grid)

# Initialize random states

key = jax.random.PRNGKey(seed)

# Initial asset distribution (start everyone at the middle of the grid)

a_init_idx = len(a_grid) // 2

assets = jnp.ones(num_households) * a_grid[a_init_idx]

# Initial employment state distribution (draw from stationary dist)

# For simplicity, start everyone in state 0

z_indices = jnp.zeros(num_households, dtype=int)

# Simulate forward

for t in range(num_periods):

# Generate random shocks for employment transitions

key, subkey = jax.random.split(key)

unif = jax.random.uniform(subkey, shape=(num_households,))

# Update employment states based on transition matrix

z_indices_new = jnp.zeros(num_households, dtype=int)

for i in range(num_households):

z_idx = z_indices[i]

# Cumulative probabilities

cum_probs = jnp.cumsum(Π[z_idx, :])

# Find which state to transition to

z_indices_new = z_indices_new.at[i].set(

jnp.searchsorted(cum_probs, unif[i])

)

z_indices = z_indices_new

# Get current income

z_current = z_grid[z_indices]

income = w * z_current + (1 + r) * assets

# Interpolate consumption policy

consumption = jnp.zeros(num_households)

for i in range(num_households):

# Use 2D interpolation: interp over assets for each z

consumption = consumption.at[i].set(

jnp.interp(assets[i], a_grid, σ[:, z_indices[i]])

)

# Update assets

assets = income - consumption

assets = jnp.maximum(assets, a_grid[0]) # Enforce borrowing constraint

return jnp.mean(assets)

The function above is fully JIT-compiled but might be slow for the loops. Let’s create a more efficient version using jax.lax.fori_loop:

def simulate_assets_efficient(σ, household, prices,

num_households=50_000,

num_periods=1000,

burn_in=500,

seed=42):

"""

Efficient simulation using numpy (numba would be even better but

we'll keep it simple with numpy for now).

"""

β, a_grid, z_grid, Π = household

r, w = prices

z_size = len(z_grid)

# Convert to numpy for simulation

a_grid_np = np.array(a_grid)

z_grid_np = np.array(z_grid)

Π_np = np.array(Π)

σ_np = np.array(σ)

# Set random seed

np.random.seed(seed)

# Initialize

a_init_idx = len(a_grid_np) // 2

assets = np.ones(num_households) * a_grid_np[a_init_idx]

z_indices = np.zeros(num_households, dtype=int)

# Simulate

for t in range(num_periods):

# Draw employment shocks

unif = np.random.uniform(size=num_households)

# Update employment states

for i in range(num_households):

cum_probs = np.cumsum(Π_np[z_indices[i], :])

z_indices[i] = np.searchsorted(cum_probs, unif[i])

# Compute income

z_current = z_grid_np[z_indices]

income = w * z_current + (1 + r) * assets

# Interpolate consumption policy

# Note: np.interp extrapolates using boundary values, which can cause

# issues if assets go far outside the grid. The grid should be large

# enough to cover the range of assets in equilibrium.

consumption = np.array([

np.interp(assets[i], a_grid_np, σ_np[:, z_indices[i]])

for i in range(num_households)

])

# Update assets

assets = income - consumption

assets = np.maximum(assets, a_grid_np[0]) # Enforce borrowing constraint

# Clip assets to grid maximum to prevent extrapolation issues

# In equilibrium, assets should stay within the grid if a_max is large enough

assets = np.minimum(assets, a_grid_np[-1])

return np.mean(assets)

Now we can compute capital supply for given prices:

def capital_supply(household, prices,

num_households=50_000,

num_periods=1000):

"""

Compute aggregate capital supply by simulation.

"""

# Solve household problem

σ = solve_household_egm(household, prices)

# Simulate to get mean assets

mean_assets = simulate_assets_efficient(

σ, household, prices,

num_households=num_households,

num_periods=num_periods

)

return mean_assets

Let’s test it:

household = create_household()

prices = Prices(r=0.01, w=1.0)

print("Computing capital supply via simulation...")

with qe.Timer():

K_supply = capital_supply(household, prices,

num_households=10_000,

num_periods=500)

print(f"Capital supply: {K_supply:.4f}")

Computing capital supply via simulation...

39.74 seconds elapsed

Capital supply: 2.6035

77.5. Computing Equilibrium#

Now we can compute the equilibrium by finding the interest rate where capital supply equals capital demand.

The equilibrium mapping is:

where \(G(K)\) computes:

Prices \((r, w)\) from firm FOCs given \(K\)

Household optimal policy given prices

Aggregate capital via simulation

def G(K, firm, household,

num_households=10_000,

num_periods=500):

"""

The equilibrium mapping K -> K'.

"""

# Get prices from firm problem

r = r_given_k(K, firm)

w = r_to_w(r, firm)

prices = Prices(r=r, w=w)

# Compute capital supply

K_supply = capital_supply(household, prices,

num_households=num_households,

num_periods=num_periods)

return K_supply

We can compute equilibrium using bisection:

def compute_equilibrium(firm, household,

K_min=1.0, K_max=20.0,

num_households=10_000,

num_periods=500,

xtol=1e-3):

"""

Compute equilibrium capital stock using bisection.

"""

def excess_demand(K):

K_supply = G(K, firm, household,

num_households=num_households,

num_periods=num_periods)

return K - K_supply

K_star = bisect(excess_demand, K_min, K_max, xtol=xtol)

return K_star

Let’s compute the equilibrium:

firm = Firm()

household = create_household()

print("Computing equilibrium capital stock...")

print("(This may take a few minutes due to simulation)")

with qe.Timer():

K_star = compute_equilibrium(

firm, household,

K_min=4.0, K_max=12.0,

num_households=5_000,

num_periods=400,

xtol=5e-2

)

print(f"\nEquilibrium capital: {K_star:.4f}")

# Get equilibrium prices

r_star = r_given_k(K_star, firm)

w_star = r_to_w(r_star, firm)

print(f"Equilibrium interest rate: {r_star:.4f}")

print(f"Equilibrium wage: {w_star:.4f}")

Computing equilibrium capital stock...

(This may take a few minutes due to simulation)

159.55 seconds elapsed

Equilibrium capital: 8.0938

Equilibrium interest rate: 0.0313

Equilibrium wage: 1.3359

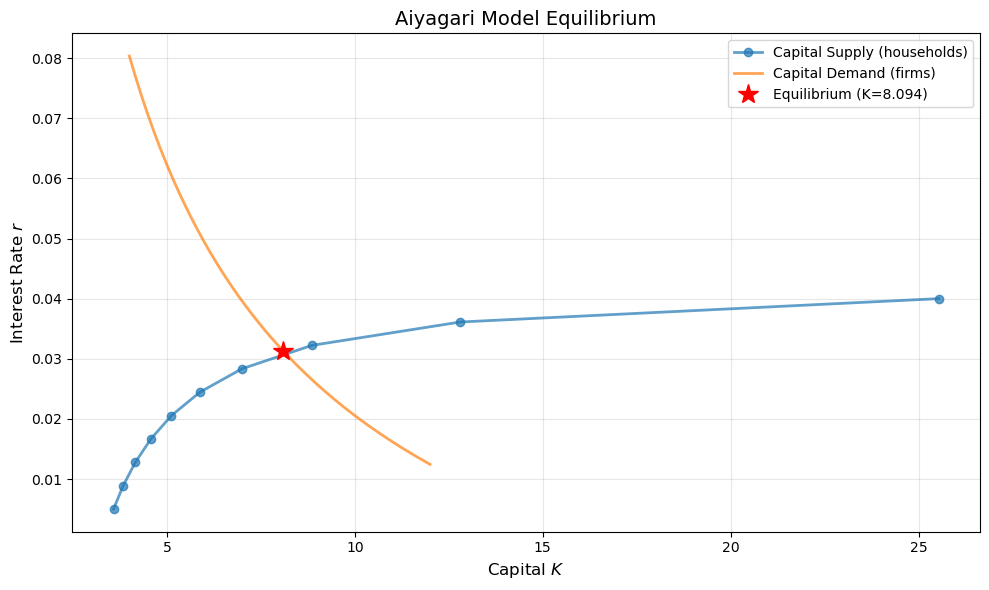

77.5.1. Visualizing equilibrium#

Let’s plot the supply and demand curves:

# Compute supply curve (capital as function of r)

r_vals = np.linspace(0.005, 0.04, 10)

K_supply_vals = []

print("Computing supply curve...")

for r in r_vals:

w = r_to_w(r, firm)

prices = Prices(r=r, w=w)

K_s = capital_supply(household, prices,

num_households=5_000,

num_periods=300)

K_supply_vals.append(K_s)

print(f" r={r:.4f}: K={K_s:.3f}")

# Demand curve

K_vals = np.linspace(4, 12, 50)

r_demand_vals = r_given_k(K_vals, firm)

# Plot

fig, ax = plt.subplots(figsize=(10, 6))

ax.plot(K_supply_vals, r_vals, 'o-', lw=2,

alpha=0.7, label='Capital Supply (households)',

markersize=6)

ax.plot(K_vals, r_demand_vals, lw=2,

alpha=0.7, label='Capital Demand (firms)')

# Mark equilibrium

ax.plot(K_star, r_star, 'r*', markersize=15,

label=f'Equilibrium (K={K_star:.3f})', zorder=5)

ax.set_xlabel('Capital $K$', fontsize=12)

ax.set_ylabel('Interest Rate $r$', fontsize=12)

ax.set_title('Aiyagari Model Equilibrium', fontsize=14)

ax.legend(fontsize=10)

ax.grid(alpha=0.3)

plt.tight_layout()

plt.show()

Computing supply curve...

r=0.0050: K=3.580

r=0.0089: K=3.836

r=0.0128: K=4.160

r=0.0167: K=4.574

r=0.0206: K=5.121

r=0.0244: K=5.878

r=0.0283: K=6.996

r=0.0322: K=8.855

r=0.0361: K=12.804

r=0.0400: K=25.534

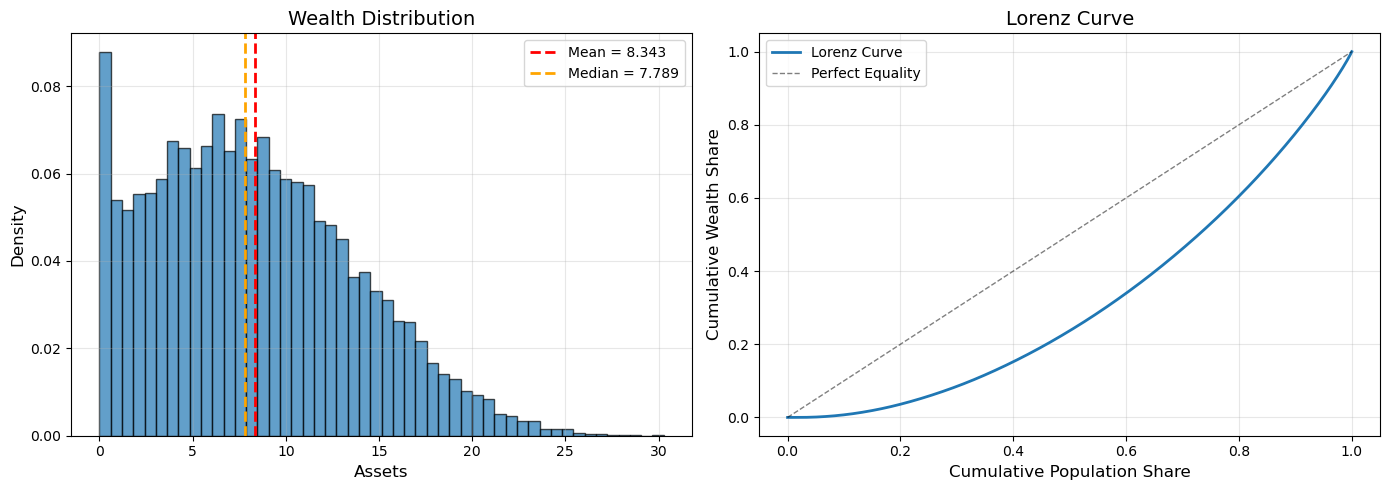

77.6. Wealth Distribution#

One advantage of the simulation approach is that we can easily examine the wealth distribution:

def simulate_wealth_distribution(household, prices,

num_households=50_000,

num_periods=1000):

"""

Simulate and return the cross-sectional wealth distribution.

"""

# Solve household problem

σ = solve_household_egm(household, prices)

β, a_grid, z_grid, Π = household

r, w = prices

# Convert to numpy

a_grid_np = np.array(a_grid)

z_grid_np = np.array(z_grid)

Π_np = np.array(Π)

σ_np = np.array(σ)

np.random.seed(42)

# Initialize

a_init_idx = len(a_grid_np) // 2

assets = np.ones(num_households) * a_grid_np[a_init_idx]

z_indices = np.zeros(num_households, dtype=int)

# Simulate

for t in range(num_periods):

unif = np.random.uniform(size=num_households)

for i in range(num_households):

cum_probs = np.cumsum(Π_np[z_indices[i], :])

z_indices[i] = np.searchsorted(cum_probs, unif[i])

z_current = z_grid_np[z_indices]

income = w * z_current + (1 + r) * assets

consumption = np.array([

np.interp(assets[i], a_grid_np, σ_np[:, z_indices[i]])

for i in range(num_households)

])

assets = income - consumption

assets = np.maximum(assets, a_grid_np[0])

return assets, z_indices

# Simulate wealth distribution at equilibrium

prices_star = Prices(r=r_star, w=w_star)

assets_dist, z_dist = simulate_wealth_distribution(

household, prices_star,

num_households=10_000,

num_periods=800

)

# Plot

fig, axes = plt.subplots(1, 2, figsize=(14, 5))

# Histogram

ax = axes[0]

ax.hist(assets_dist, bins=50, density=True, alpha=0.7, edgecolor='black')

ax.axvline(np.mean(assets_dist), color='red', linestyle='--',

linewidth=2, label=f'Mean = {np.mean(assets_dist):.3f}')

ax.axvline(np.median(assets_dist), color='orange', linestyle='--',

linewidth=2, label=f'Median = {np.median(assets_dist):.3f}')

ax.set_xlabel('Assets', fontsize=12)

ax.set_ylabel('Density', fontsize=12)

ax.set_title('Wealth Distribution', fontsize=14)

ax.legend()

ax.grid(alpha=0.3)

# Lorenz curve

ax = axes[1]

sorted_assets = np.sort(assets_dist)

cum_wealth = np.cumsum(sorted_assets) / np.sum(sorted_assets)

cum_pop = np.linspace(0, 1, len(sorted_assets))

ax.plot(cum_pop, cum_wealth, lw=2, label='Lorenz Curve')

ax.plot([0, 1], [0, 1], 'k--', lw=1, alpha=0.5, label='Perfect Equality')

ax.set_xlabel('Cumulative Population Share', fontsize=12)

ax.set_ylabel('Cumulative Wealth Share', fontsize=12)

ax.set_title('Lorenz Curve', fontsize=14)

ax.legend()

ax.grid(alpha=0.3)

plt.tight_layout()

plt.show()

# Compute Gini coefficient

gini = 1 - 2 * np.trapz(cum_wealth, cum_pop)

print(f"\nGini coefficient: {gini:.4f}")

Gini coefficient: 0.3649

/tmp/ipykernel_2839/1845471123.py:89: DeprecationWarning: `trapz` is deprecated. Use `trapezoid` instead, or one of the numerical integration functions in `scipy.integrate`.

gini = 1 - 2 * np.trapz(cum_wealth, cum_pop)

77.7. Summary and Comparison#

This lecture demonstrated how to solve the Aiyagari model using:

Endogenous Grid Method (EGM) for the household problem

Avoids costly root-finding by working backwards from the Euler equation

Directly computes consumption from marginal utility

More efficient than value function iteration

Simulation for computing aggregate capital

Simulates a large cross-section of households

More flexible than analytical stationary distributions

Allows easy computation of wealth inequality measures

77.7.1. Comparison with standard approach#

Compared to the standard Aiyagari lecture:

Advantages:

EGM is faster than Howard iteration (no root-finding needed)

Simulation is more flexible (works with continuous shocks, non-linear policies)

Easy to compute distributional statistics (Gini, percentiles, etc.)

Simpler to extend to more complex models

Disadvantages:

Simulation requires large number of households for accuracy

Equilibrium computation is slower due to simulation

Less precise than analytical stationary distribution

77.7.2. Extensions#

This framework can be easily extended to:

Continuous income shocks (e.g., lognormal)

More complex preference specifications

Aggregate shocks and heterogeneous agent New Keynesian (HANK) models

Life-cycle models with age-dependent policies

77.8. Exercises#

Exercise 77.1

Compare the speed and accuracy of EGM vs. Howard iteration for solving the household problem.

Implement a version that uses Howard iteration (you can adapt code from the standard Aiyagari lecture)

Time both methods and compare the resulting policies

Which method is faster? Are the policies identical?

Exercise 77.2

Study how the wealth distribution changes with the discount factor \(\beta\).

Compute equilibria for \(\beta \in \{0.94, 0.95, 0.96, 0.97\}\)

For each \(\beta\), compute and plot the wealth distribution

How does the Gini coefficient change with \(\beta\)?

Explain the economic intuition

Exercise 77.3

The simulation method introduced in this lecture uses a fixed number of periods. Investigate the impact of this choice:

Vary

num_periodsfrom 200 to 2000For each value, compute the mean assets multiple times with different random seeds

Plot the standard deviation of the capital estimate as a function of

num_periodsWhat is the trade-off between accuracy and computational cost?

Exercise 77.4

Extend the model to include a third employment state (e.g., unemployed, part-time, full-time):

Set up a 3-state Markov chain with appropriate transition probabilities

Define income levels for each state

Re-compute the equilibrium

How does the additional heterogeneity affect the wealth distribution?